LazyPay: Loan App & Pay Later 10.6.0

Free Version

Publisher Description

LazyPay: Loan App & Pay Later - India’s credit super-app for Instant loans, BNPL, Utility bills and more

India’s credit super-app for Instant loans, BNPL, Utility bills and more

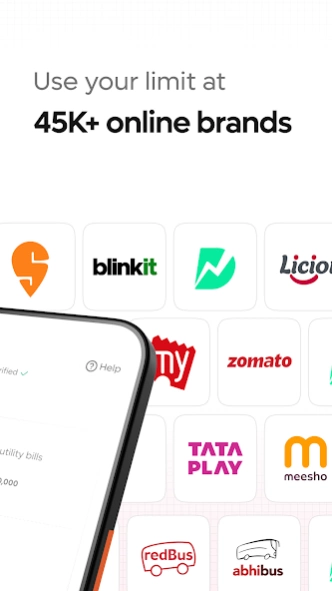

Get credit that’s easy, instant and stress-free. With LazyPay, you get a free credit upto Rs.10,000 that you can use across 45,000+ online stores and merchants! Just repay the total every 15 or 30 days, interest-free.

Here’s what you can do on LazyPay:

For personal loans, XpressLoan option allows you to borrow upto Rs 5 lakhs. Get online loans within minutes and use them for anything you want - no questions asked. Instant Personal loan interest rates range from 15% to 32% p.a. Its repayment flexibility spans 3 to 24 months.

With our instant personal loan, which complies with RBI guidelines, you can conveniently settle bills, recharge your mobile, and shop for the latest electronics and home appliances. Simplify your financial needs and relationships with us!

What does LazyPay offer?

Your search for the ultimate loan app for Instant Loans and Flexible EMIs ends here! LazyPay offers financial solutions at the palm of our hand that include -

⚡XpressLoan: Instant Personal Loans: With our app, you can instantly borrow a credit up to Rs. 5 lakhs through the XpressLoan option. The interest rates are competitive, and you only pay interest on the amount you borrow.

XpressLoan by LazyPay app ranges from Rs. 3,000 to Rs. 5 lakhs with an Annual Repayment Period (APR) of 3 to 60 months. Percentage rate (APR) between 15% - 32% on a reducing balance basis.

★Sample Loan EMI Calculation★

For a loan amount = Rs 10,000 | Tenure = 6 months @ interest rate of 18%* p.a.

EMI will be = Rs 1,755/- p.m.

Processing fee = Rs. 200

Total Payment = Rs. 10,730

*Interest rate and processing fee may vary.

---------

Revolve rates - 36% to 42%. For Revolve there is no period for repayment. It's a monthly rolling feature.

Convert to EMI - 3 month 24% | 6 month 26% Tenure basis - 3 to 6 months.

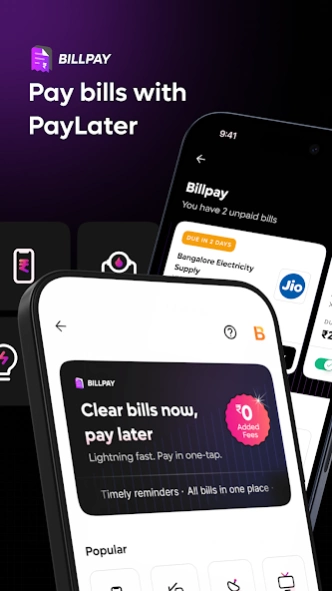

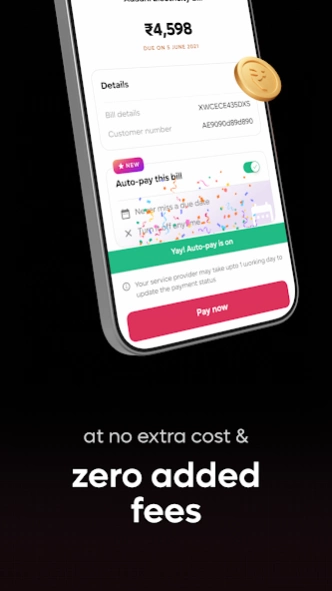

🛒Buy Now Pay Later: Shopping online with pay later apps is always convenient. With BillPay by LazyPay, you can shop at 100+ merchants and choose the "Pay Later" option at checkout. It supports over 20,000+ billers in categories such as electricity, water, gas line, gas cylinder, DTH, FASTag, landline, internet, and many more. Just provide some basic information and get your credit limit checked. LazyPay will remind you regularly, and you can track your spending and make fast repayments.

★ Get attractive discounts and offers on various merchants like Swiggy, Zomato, Myntra, Zepto and more.

No-Cost EMI: Enjoy shopping at your favourite online stores like Flipkart and Amazon with no-cost or low-cost EMIs. No need for a credit card or worry about high-interest rates. Sign up, choose your preferred store, and apply for 3 to 12 months of EMI offers.

🔌BillPay: Pay Utility Bills

[Currently open to select users]

With over 20,000+ supported billers, LazyPay allows you to pay utility bills with your credit limit. Pay electricity, gas, water bills in one-click; recharge FASTag, mobile postpaid, mobile prepaid, landline, DTH and more. Repay in one shot, along with your LazyPay dues, every 15 or 30 days.

Why should you choose LazyPay?

• Best Pay Later App with flexible EMI tenures

• Shop on EMI with 45000+ stores

• Collateral-Free Personal Loan

• No CVVs or PINs

• 100% digital process with no paperwork

• Instant loan approval and disbursal

Choosing a reliable loan app like LazyPay comes with another significant benefit – you only pay interest on the amount you borrow. This unique feature grants you the freedom to take exactly what you need, reducing the burden of unnecessary interest expenses.

Declaration

LazyPay is a platform that only facilitates money lending to duly registered NBFCs to users and complies with all applicable laws including RBI’s Fair Practices code. The details of the registered NBFCs who are partnered with us are mentioned below.

PayU Finance India Private Limited (“PayU Finance”)

https://www.payufin.in/

About LazyPay: Loan App & Pay Later

LazyPay: Loan App & Pay Later is a free app for Android published in the Accounting & Finance list of apps, part of Business.

The company that develops LazyPay: Loan App & Pay Later is PayU Finance (India) Private Limited. The latest version released by its developer is 10.6.0.

To install LazyPay: Loan App & Pay Later on your Android device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2024-04-14 and was downloaded 77 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the LazyPay: Loan App & Pay Later as malware as malware if the download link to com.citrus.citruspay is broken.

How to install LazyPay: Loan App & Pay Later on your Android device:

- Click on the Continue To App button on our website. This will redirect you to Google Play.

- Once the LazyPay: Loan App & Pay Later is shown in the Google Play listing of your Android device, you can start its download and installation. Tap on the Install button located below the search bar and to the right of the app icon.

- A pop-up window with the permissions required by LazyPay: Loan App & Pay Later will be shown. Click on Accept to continue the process.

- LazyPay: Loan App & Pay Later will be downloaded onto your device, displaying a progress. Once the download completes, the installation will start and you'll get a notification after the installation is finished.